Film Financing—The Ultimate Guide for Filmmakers

In filmmaking, a crucial aspect that often poses a challenge to many is film financing. Whether you're an established film producer or an independent filmmaker, navigating the complex financing world can be daunting.

To help you succeed in your filmmaking journey, I've created the ultimate guide for filmmakers that covers all aspects of film financing.

In this comprehensive guide, we'll explore various film funding sources, discuss strategies, and dive into the intricacies of the financing process.

Film Financing Overview

Film financing is raising the necessary funds for producing a motion picture. It involves various sources, such as private investors, film financing companies, government grants, tax credits, etc.

In this section, we'll break down the key players in the film financing landscape and explore their roles in funding film projects.

Film financing companies: These companies specialize in financing film projects, offering a range of services such as gap financing, slate financing, and equity financing. They may also provide production loans, which can be used to cover a film's production costs.

Private investors: Private or equity investors are individuals or entities investing their money into film projects. They are often drawn to the entertainment industry due to the potential for high returns, despite the risk involved.

Debt financing: This type of financing involves borrowing money to fund a film's production. The interest charged reflects the risk associated with the project, and the loan must be repaid in addition to the interest.

Government grants: Many governments offer grants to support the film industry. These grants can cover a portion of a film's production cost.

Tax incentives: Several countries and states offer tax incentives to encourage film production. These incentives can include tax credits, tax breaks, and other financial support mechanisms.

Types of Film Financing

Several types of film financing are available to independent filmmakers, each with benefits and challenges. In this section, we'll explore some of the most common types of financing, including:

Private equity film financing: Private equity firms are investment companies that pool capital from various sources to invest in multiple projects, including films. They typically invest in high-budget films with a proven track record, although some may also invest in independent films with strong potential.

Gap financing: Gap financing is a form of debt financing used to cover the difference between a film's production budget and the funds already secured. It is typically used for films that have secured some financing but require additional funds to complete production.

Slate financing: Slate financing is a type of film financing in which an investor or financing company provides funding for a group of films, often produced by a single production company. This approach spreads the risk across multiple projects, increasing the likelihood of a successful return on investment.

Pre-sales: Pre-sales involve selling the distribution rights to a film before completion. This can give a filmmaker the necessary funds to complete the production while demonstrating the film's commercial potential to other investors.

Crowdfunding: Crowdfunding is a popular method for raising funds for independent films, as it allows filmmakers to connect directly with their audience and generate financial support for their projects. Filmmakers often use platforms like Kickstarter and Indiegogo to launch crowdfunding campaigns.

Tax credits and incentives: Tax credits, tax breaks, and other incentive programs can provide significant financial support for filmmakers. These incentives can be offered by national, state, or local governments and may cover a portion of the film's production costs or provide direct financial support.

Negative pickup deals: A negative pickup deal is an agreement between a film producer and a distributor wherein the distributor agrees to purchase the completed film at a predetermined price. This guarantees a certain level of financial return for the producer, making it easier to secure financing for the project.

Co-productions: Co-productions involve partnering with production companies from different countries to share the costs and risks of producing a film. This approach can help filmmakers access additional funding sources while taking advantage of international tax incentives and subsidies.

Strategies for Securing Funding

Securing funding for a film project can be a challenging and time-consuming process. Here are some strategies that can help increase your chances of success:

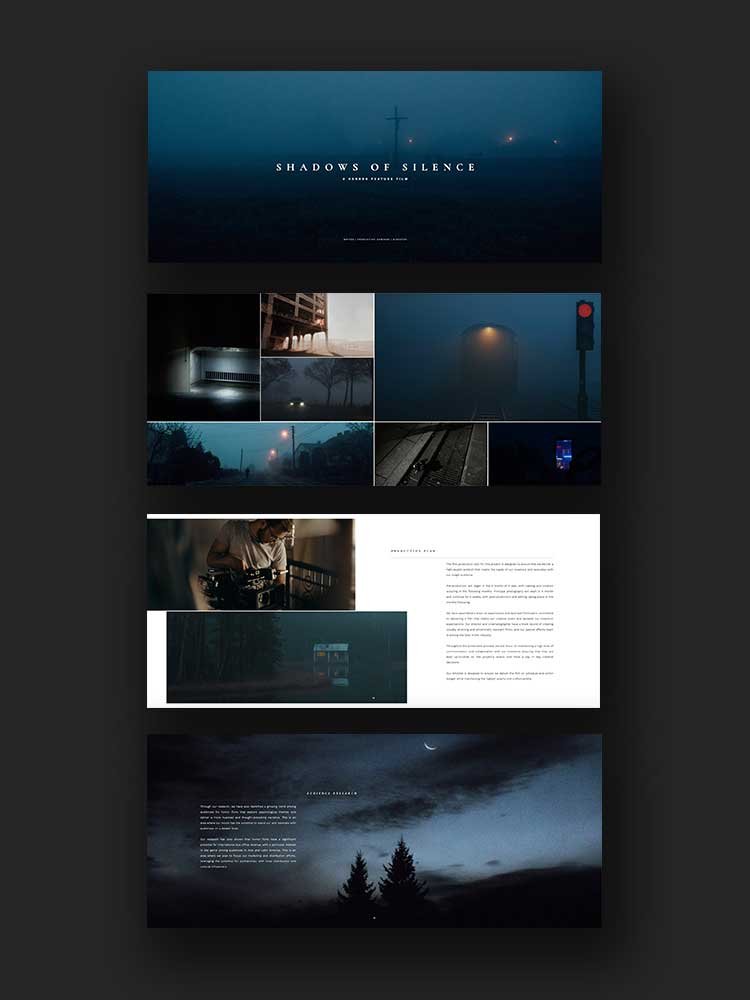

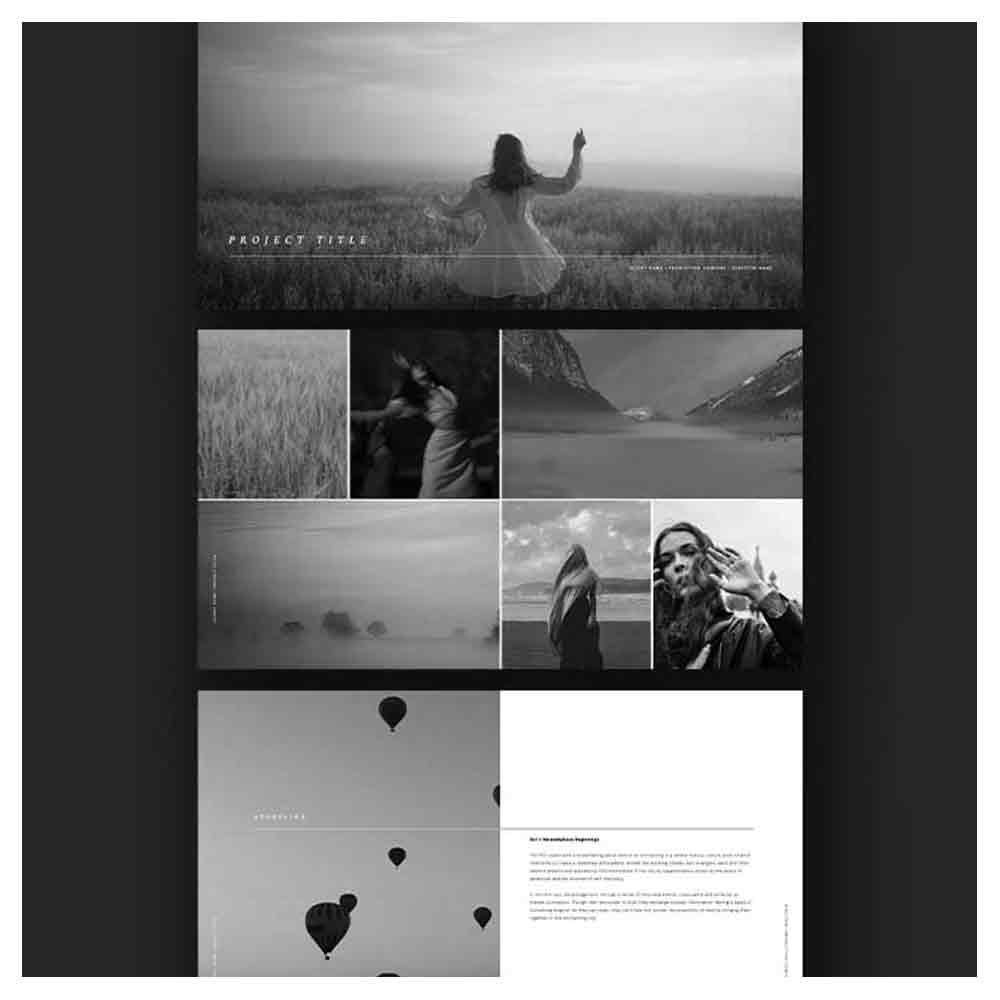

Develop a strong pitch: A compelling pitch is essential for attracting investors and financing partners. Be prepared to communicate your film project's concept, target audience, and commercial potential.

Create a professional business plan: A detailed business plan can demonstrate your project's viability and help potential investors understand the risks and rewards associated with your film. Include information on the production budget, projected revenues, and financing structure.

Leverage your network: Reach out to personal contacts, attend film festivals, and participate in industry events to build relationships with potential investors, collaborators, and other key players in the film industry.

Utilize online platforms: Social media and crowdfunding platforms can help you connect with potential investors and raise funds for your project. Be proactive in promoting your film and engaging with your audience.

Consider alternative funding sources: In addition to traditional film financing options, explore other funding sources, such as corporate sponsorship, product placement, and branded content partnerships.

Incentives and Tax Credits

Tax incentives and credits play a crucial role in film financing, as they can provide significant financial support for filmmakers. Here's a brief overview of the types of tax credit and incentives available:

Production tax credits: Governments offer tax credits to incentivize film production in their jurisdiction. These credits can offset production costs, making it more affordable for filmmakers to produce their projects.

Post-production tax credits: Some jurisdictions offer tax credits for post-production services, such as editing, sound design, and visual effects. These credits help reduce the overall cost of completing a film project.

Location-based incentives: Certain locations offer financial incentives to filmmakers who shoot their projects in specific areas. These incentives can include cash grants, reduced permit fees, and access to discounted or free resources.

Co-production incentives: Governments offer co-production incentives to encourage collaboration between production companies from different countries. These incentives can support projects that meet specific criteria, such as cultural relevance or economic impact.

International Considerations

When seeking financing for your film project, it's essential to consider the international market. Some key considerations include the following:

Foreign distributors: Partnering with foreign distributors can help expand your film's reach and generate additional revenue streams. Additionally, pre-sales to foreign distributors can provide valuable financing for your project.

International co-productions: Collaborating with global production companies can open up new funding sources and help you access tax incentives and subsidies in different countries. This approach allows you to tap into local talent and resources, potentially reducing production costs.

Foreign market appeal: Consider the potential appeal of your film to foreign audiences. Movies with solid international appeal may quickly secure financing from foreign investors and distributors.

International film festivals: Participating in international film festivals can provide valuable networking opportunities and help you connect with potential investors and partners. It can also boost your film's visibility and appeal to foreign markets.

Currency fluctuations: Consider fluctuations when planning your film's budget and financing structure. Changes in exchange rates can impact the value of your film's revenue and affect the profitability of your project.

Film Festivals and Networking

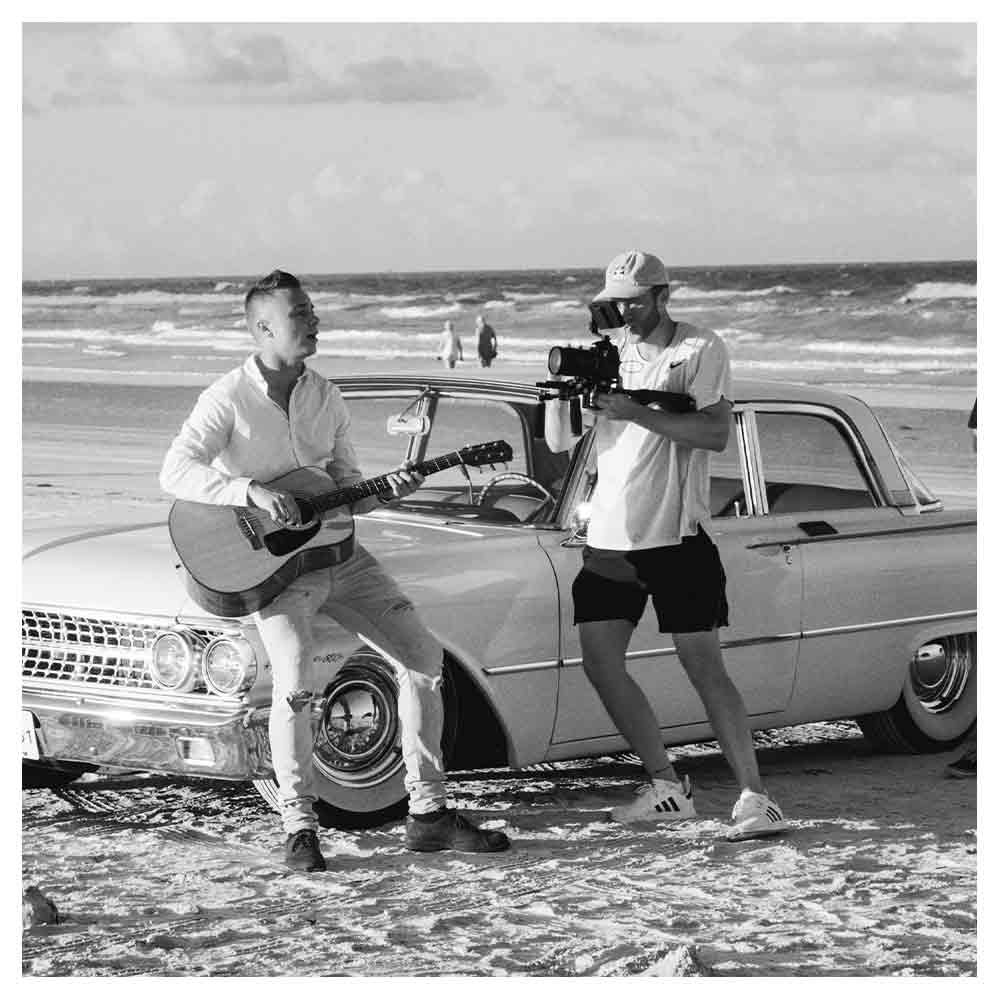

Film festivals can play a crucial role in the filmmaking process by providing opportunities for networking, showcasing your work, and attracting financing partners.

Here are some tips for leveraging film festivals to secure funding for your project:

Submit your film to festivals: Research and submit your film to festivals that cater to your project's genre, target audience, and distribution goals.

Attend industry events: Film festivals often host industry events, panels, and workshops that provide valuable networking opportunities. Attend these events to meet potential investors, collaborators, and industry professionals.

Promote your film: Use your presence at film festivals to promote your project and generate buzz. Create a press kit, engage with your audience on social media, and participate in interviews and Q&A sessions.

Build relationships: Cultivate relationships with industry professionals, fellow filmmakers, and potential investors at film festivals. These connections can open doors to new financing opportunities and partnerships.

Conclusion

Film financing can be complex and challenging, but with the right strategies, resources, and perseverance, filmmakers can successfully secure the necessary funds to bring their projects to life.

By understanding the various types of film financing, exploring incentives film grants and tax credits, and leveraging film festivals and networking opportunities, filmmakers can confidently navigate the world of film financing and ultimately achieve their creative vision.

As you embark on your filmmaking journey, we hope this ultimate guide provides you with the knowledge and inspiration needed to overcome the challenges of film financing and make your cinematic dreams a reality.

Frequently Asked Questions About Film Financing (FAQs)

What is film financing?

Film financing is securing the necessary funds to produce a motion picture. It involves various funding sources, such as private investors, film financing companies, government grants, tax credits, etc.

How can I secure financing for my film project?

To secure financing for your film project, you can explore various sources, such as private investors, film financing companies, government grants, tax credits, and crowdfunding.

You should also develop a strong pitch, create a professional business plan, leverage your network, and use online platforms to connect with potential investors.

What are the different types of film financing?

Some common types of film financing include private equity film financing, gap financing, slate financing, pre-sales, crowdfunding, tax credits and incentives, negative pickup deals, and co-productions.

What are tax incentives and credits?

Tax incentives and credits are financial support mechanisms national, state, or local governments provide to encourage film production.

They can include tax credits, tax breaks, and other financial support that can be used to offset a portion of a film's production costs or provide direct financial support.

How do I create a strong pitch for my film project?

To create a strong pitch for your film project, be prepared to communicate your project's concept, target audience, and commercial potential.

Use visuals, such as storyboards or concept art, to help convey your vision, and practice your pitch to ensure you can confidently present it to potential investors.

What role do film festivals play in film financing?

Film festivals can play a crucial role in film financing by providing opportunities for networking, showcasing your work, and attracting financing partners.

By participating in film festivals, you can connect with potential investors, collaborators, and industry professionals, boost your film's visibility, and appeal to foreign markets.

What are the benefits of international co-productions?

International co-productions can provide access to additional funding sources, tax incentives, and subsidies in different countries.

Collaborating with global production companies can also help you tap into local talent and resources, potentially reducing production costs and increasing your film's appeal to foreign markets.

How can crowdfunding help finance my film project?

Crowdfunding is a popular method for raising funds for independent films, as it allows filmmakers to connect directly with their audience and generate financial support for their projects.

Filmmakers often use platforms like Kickstarter and Indiegogo to launch crowdfunding campaigns, which can help cover a portion of the production costs and demonstrate the film's commercial potential to other investors.

What should be included in a film business plan?

A film business plan should provide detailed information about the project, including the story synopsis, target audience, production budget, projected revenues, and financing structure.

It should also outline the production timeline, marketing strategy, distribution plan, and key personnel involved in the project.

A well-prepared business plan can demonstrate your project's viability and help potential investors understand the risks and rewards associated with your film.

How do pre-sales work in film financing?

Pre-sales involve selling the distribution rights for a film before it's completed. Filmmakers can negotiate pre-sale agreements with distributors in various territories, securing a portion of the film's revenue upfront.

This guaranteed revenue can be used as collateral to secure additional financings, such as bank loans or equity investments.

What is a negative pickup deal?

A negative pickup deal is an agreement between a film producer and a distributor wherein the distributor agrees to purchase the completed film at a predetermined price.

This guarantees a certain level of financial return for the producer, making it easier to secure financing for the project.

What are some alternative funding sources for film projects?

In addition to traditional film financing options, filmmakers can explore alternative funding sources, such as corporate sponsorship, product placement, and branded content partnerships.

These funding sources can provide additional financial support, help offset production costs, and enhance the film's commercial appeal.

How can film producers leverage state tax credits in New Mexico to reduce production costs?

Producers can apply for New Mexico's state tax credits to offset up to 30% of their production costs, effectively lowering the financial burden and making the project more attractive to potential financiers.

What strategies should filmmakers employ to negotiate more favorable gap financing terms with private equity firms?

Filmmakers should present a solid business plan, showcase previous success, and offer private equity firms clear exit strategies to secure more favorable terms on gap financing.

How can independent film producers use intellectual property as collateral for securing film financing?

Secure loans or investments by offering intellectual property as collateral, ensuring lenders can recoup investments through rights to the film's distribution and sales revenues.

Can film festivals in many countries serve as a platform for securing international distribution deals?

Yes, showcasing films at international festivals can attract global distribution companies, providing a platform to negotiate deals that cover multiple territories.

What role does principal photography play in determining the financial success of TV show adaptations into feature films?

Principal photography's quality and efficiency often influence a project's appeal to investors and distributors, directly impacting the financial success of TV adaptations in the movie business.

How have distribution companies evolved their strategies in recent years to handle both theatrical and streaming releases?

Distribution companies now often negotiate hybrid deals, allowing films to have both theatrical runs and streaming releases, maximizing revenue streams and market reach.

What are the pros and cons of using debt financing versus equity investors for film productions?

Debt financing keeps creative control with filmmakers but requires fixed repayments; equity investors provide more flexible funding but often demand a share in profits and decision-making.

How can production companies structure deals with catering companies to manage additional costs effectively?

Negotiate bulk deals or sponsorships with catering companies to manage food costs, which can be a significant part of the budget, especially in large-scale productions.

What unique selling points should filmmakers present to sales agents when negotiating pre-sales agreements?

Highlight the film’s unique elements, potential market appeal, star cast, and any preliminary awards or festival recognitions to secure better terms in pre-sale contracts.

How do minimum guarantees from major studios impact the financial return for independent filmmakers?

Minimum guarantees ensure a fixed revenue, reducing financial risk and providing a safety net that can help secure additional funding from other parties.

What innovative methods are indie producers using to combine crowdfunding with traditional film financing mechanisms?

Indie producers often use crowdfunding to raise initial funds and validate the project's market appeal, which can leverage additional traditional financing based on demonstrated public interest.

How do distribution agreements vary between different types of films, such as independent films vs. studio blockbusters?

Independent films typically negotiate distribution deals with more flexibility but lower upfront payments, whereas blockbusters often secure extensive global deals with substantial minimum guarantees.

What new trends in film finance have emerged from the utilization of soft money and tax incentives?

There's increasing reliance on soft money, including state and federal tax incentives, which lower production costs and attract financing by providing direct financial benefits to investors.

How can filmmakers structure their film's budget to include funds for post-production services without compromising artistic merit?

Allocate a specific portion of the budget for post-production early in the planning stage, ensuring that cutting-edge editing, sound, and visual effects are secured without financial compromise.

What are the implications of film grants on the overall financial structure of a film project in stimulating employment in the local economy?

Film grants not only aid in covering production costs but also boost local economies by creating jobs, requiring local services, and utilizing regional talents, which can also bring additional state support.

How can new filmmakers navigate the complex landscape of film finance to secure funding from less conventional sources like TV networks or digital media platforms?

New filmmakers should focus on creating content that aligns with the strategic interests of TV networks and digital platforms, often looking for unique, high-engagement content, and leverage that alignment in negotiations.

In what ways can international co-productions benefit from different tax incentives provided by the involved countries to enhance the financial viability of a project?

International co-productions can tap into various tax incentives from involved countries, allowing producers to craft a financial strategy that minimizes costs and maximizes funding sources across borders.

How do successful film producers manage the balance between creative goals and financial imperatives when crafting a viable production budget?

Successful producers prioritize key creative elements that define the film's artistic vision while strategically cutting costs in less critical areas and leveraging financial mechanisms like pre-sales and tax credits.

What are the implications for filmmakers when a studio agrees to a negative pickup deal, and how should they prepare for the financial and production risks involved?

Filmmakers must ensure that the film can be completed within the agreed budget as the studio's purchase is contingent upon meeting the contracted specifications; careful budget management and contingency planning are essential.